General information

Welcome to your comprehensive and user-friendly investment tracker for both cryptocurrencies and stocks! This guide is tailored for the Basic Edition of the Crypto & Stocks Investment Tracker v1.0. If you’re interested in a guide for the premium trackers, kindly choose from the other available guides in the menu.

The Basic Edition provides you with essential tools such as a relevant newsfeed and financial summary tool – all for FREE! This version caters to most investors’ needs, but if you’re looking for advanced features like net worth tracking and realized gains overview (FIFO/LIFO), be sure to check out the Premium Trackers.

In this guide, we’ll walk you through setting up the tracker and acquaint you with the key sheets.

Setting up the tracker

Follow these simple steps to set up your tracker:

- Step 1: In the ‘Setup’ sheet, input your data in the account box (up to 30 entries). For example, enter various brokers and/or exchanges. Need to increase the limit? Contact me for more information.

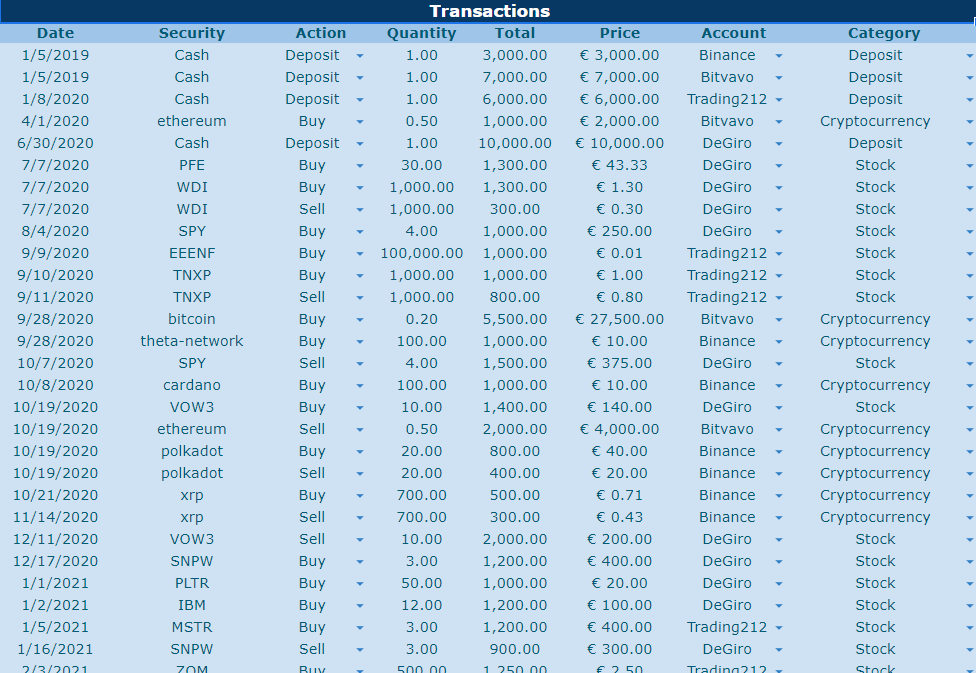

- Step 2: Go to the ‘History’ sheet and observe how the data is entered. Use the slang of the currency, not the symbol (e.g., “bitcoin” instead of “BTC”). Delete columns A to E but keep column “F” for average price calculation. Delete columns “G” and “H” too. Now, input your transaction history, adding any fees to the total purchase cost. Don’t modify any data here.

- Step 3: In the ‘Positions’ sheet, add an “=” sign in cell A3 to activate the formula. This custom formula calculates symbol, shares, and average cost for shares using FIFO, based on the ‘History’ sheet. Change the input data in the ‘History’ sheet if needed.

- Step 4: Inside the ‘Cryptocurrency’ box, fill in columns “F” (Symbol/Currency) and “G” (Cryptocurrencies Owned) to generate a sparkline in the dashboard.

- Choose your desired output currency in the ‘Main Currency’ box (e.g., “USD” for the United States or “EUR” for Europe).

- Step 6: Input the original currency you purchased the stock in the designated box for stocks. Change only the data in column N!

- Step 7: Click ‘Activate Trigger’ to enable the IMPORTHTML functions for updating cryptocurrency prices (every 15 mins) and sector/industry data (every 12 hours). Authorize the script by clicking Continue > Choose your Gmail account > Advanced > Go to the portfolio (unsafe).

- Step 8: Optional: Manually update price data of cryptocurrencies and sector/industry for stocks via the custom menu as needed.

Now, you’re all set to track your investments like a pro with the Basic Crypto & Stocks Investment Tracker!

Additional information

- Cryptocurrency price data is sourced from Coingecko using the IMPORTHTML function, refreshing hourly. Activating a trigger forces a refresh every 10 minutes. Use the slang of the cryptocurrency, not the symbol (e.g., “bitcoin” instead of “BTC”).

- To verify the correct slang, search for your coin on the Coingecko website and check the URL’s last part. For instance, for THETA, the link is “https://www.coingecko.com/en/coins/theta-network“, meaning you should use “theta-network” in the history sheet.

- Stock price data is retrieved through the Googlefinance function, refreshing every 20 minutes. Ensure that the stocks and local currency are written in a format recognizable by Google Finance. If necessary, include the stock exchange before the symbol (e.g., “NYSE:GME” instead of “GME”).

- In the history sheet, the total purchase costs should account for all expenses, including exchange fees and transactional costs.

- The Money-Weighted Rate of Return (MWRR) calculates your total portfolio performance. Ensure accurate cash inflow & outflow entries (e.g., deposits & withdrawals) for reliable results.

- The “cryptofinance” function, used for creating a sparkline in the dashboard, has a daily limit of 25 requests. If the graph doesn’t appear, you may have reached the limit.

- To adjust the spreadsheet size, go to “View” and change the “Zoom” (e.g., 75% for a 15-inch laptop screen).

- The tracker supports up to 100 stocks and 30 cryptocurrencies by default. For more extensive support, contact me for further information.

Description of spreadsheet

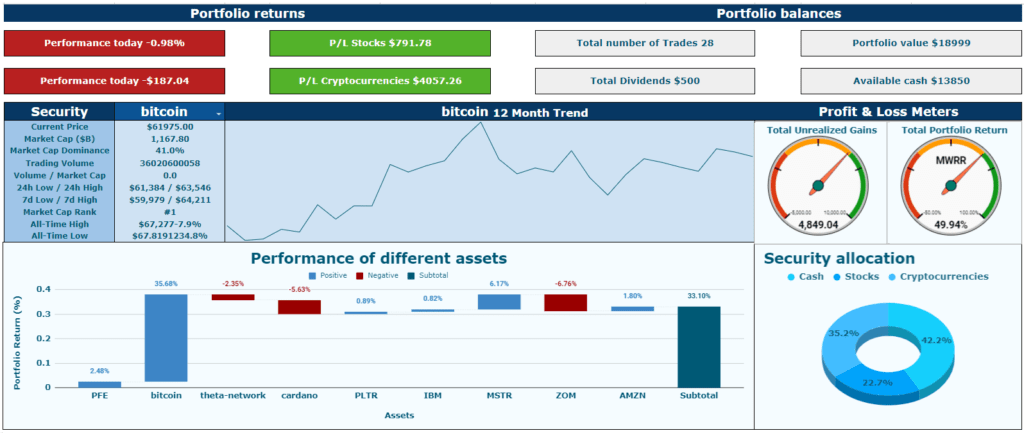

Dashboard

The Dashboard is the first sheet you’ll see after the Setup sheet. It provides a summary of the key aspects of your portfolio. At the top, you’ll find daily performance and the performance of your cryptocurrencies and stocks. Additionally, the top right displays your current cash and account balances. In the middle-right section, you can see your total unrealized gains and overall portfolio performance.

To view key metrics for a specific asset, click the arrow next to the symbol’s name (e.g., bitcoin), and the tracker will display financial metrics and a sparkline. The waterfall chart shows the unrealized gains (or losses) of your portfolio and the relative contributions of each asset. For instance, a 90% loss on a stock may have a minimal impact on your portfolio if you initially invested only $100 in that stock.

History

The History sheet serves as the data input area. As a user, you need to fill in this sheet with your transaction data. The spreadsheet uses the information from this sheet to perform all calculations. If you want to modify anything in the rest of the spreadsheet, make changes to the History sheet.

Positions

The Positions sheet is arguably the most important one, as it gives you an overview of all your current holdings. It includes essential information such as average cost basis, portfolio allocation, cost basis, sector, industry, market cap, daily price change, purchase cost, position value, gains or losses, and portfolio return.

Analysis of portfolio

This sheet offers a graphical overview of your investments, helping you make informed decisions about your portfolio. By examining various allocations, you can determine if rebalancing is necessary and assess your portfolio’s diversification across industries and sectors. Additionally, the account balance graph shows a summary of your balances per account – hover your mouse over the graph to see specific values.

Investor return

The Investor Return sheet provides an overview of all your returns over a specific holding period. Use the drop-down list in cell “H4” to select your total portfolio, cryptocurrencies, or stocks. The graphs in this sheet dynamically change based on the values of the drop-down list and any updates made in the History sheet. The first chart shows gains or losses for individual assets, while the second chart displays your overall portfolio return. The final charts are gauge meters indicating your total return based on the money-weighted rate of return and the total dividends received.

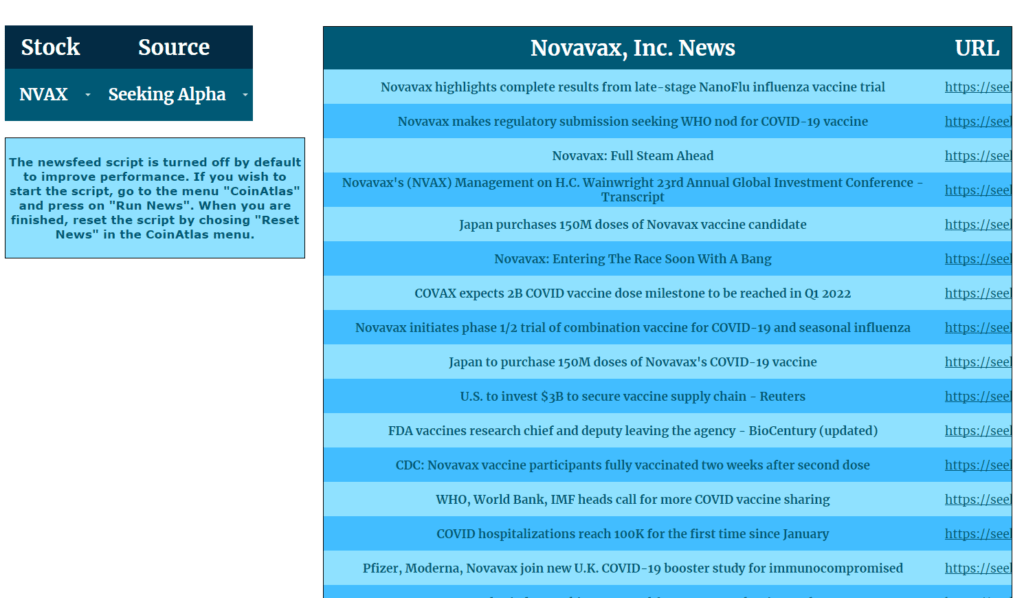

Newsfeed

In the Newsfeed sheet, click the arrow in cell “D7” to see a drop-down list of all your stock holdings. Choose a stock and click on your preferred news source – “Seeking Alpha” or “Yahoo Finance” for stocks, or “Cryptoninjas,” “Coindesk,” or “Cointelegraph” for general cryptocurrency news.

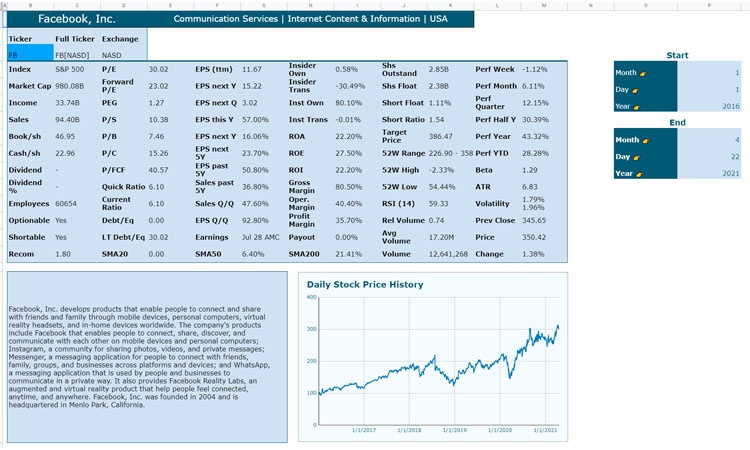

Financial Screener

The Financial Summary sheet extracts a table from finviz.com, providing financial information on a specific stock. Enter the stock symbol in cell “C3,” and the table should update automatically. Note that Finviz only supports US stocks. A historical price chart is also available, which you can adjust by entering different dates in cells “P4” to “P10.”

44 Comments

Diogo · November 24, 2021 at 3:45 pm

Hi,

Finally a tracker for both stocks and crypto that I can easily use…

Is this tracker paid? I seem to be unable to find a link to download anywhere…

Pashtun · November 24, 2021 at 4:05 pm

Hi Diego,

Thanks for your interest in the tracker. As explained at the homepage and the most recent news update, the basic edition of the tracker is free and will remain free. Gain access by subscribing to my newsletter available at homepage (you will receive automatic email with link to tracker). Premium edition is free since it is in beta mode untill 01-01-2022. To gain access, read this.

Emily · November 29, 2021 at 12:24 pm

Hi there, I’ve tried subscribing using 2 different email addresses but nothing’s been sent to me, it’s not in my spam folder either. Could you please check? Thanks. Just wanna try out the basic one first as I’m just a beginner.

Pashtun · November 30, 2021 at 2:53 pm

Just sent you an email with the basic tracker! Let me know if you need any more help.

aziz · December 7, 2021 at 10:34 am

Hi,

I have registered to get the link, but still didn’t receive any mail.

Thanks for your assistance.

Pashtun · December 8, 2021 at 5:50 am

I just sent you an email with a link to the tracker

aziz · December 8, 2021 at 11:04 am

Got the link.

Thanks for sharing.

Chems · December 22, 2021 at 11:19 am

Hi,

I have registered to get the link, but still didn’t receive any mail.

Thanks for your assistance.

Pashtun · December 23, 2021 at 12:35 pm

Link is sent to you. Check your email.

Rahul · January 5, 2022 at 1:30 pm

Hi,

I’ve registered here but didn’t get any email or link for tracker.

Please let me know how to get that.

Thanks in advance.

Jeff · January 6, 2022 at 10:17 pm

Hi,

Can I please get a link to the free crypto tracker? Thanks.

Pashtun · January 10, 2022 at 6:17 pm

Hi Jeff,

The way to get access is by subscribing to my newsletter at the homepage (scroll down to the bottem).

If you don’t find an automatic email with the link, please check spam folder. Otherwise comment here again and I will send it to you personally.

Best regards,

Pashtun

Art · January 17, 2022 at 11:52 pm

Thank you so much for this. I have added my broker names to the account, however only 5 of them are coming up, and not in the specific order. Anyway I can make all the brokers appear in the history when I put in the trades?

Thank you

Pashtun · January 22, 2022 at 12:28 pm

Hi Art, yes there is a way to increase the amount of brokers. Select the column in the history sheet, right click, click on data validation, increase the amount of cells in the setup sheet, e.g. from just 5 cells to 20 cells (this will then allow 20 brokers to be selected).

Let me know if you still have trouble.

cosset · January 20, 2022 at 11:35 am

Hi signed up but no link visible on my inbox.

Regards.

Pashtun · January 22, 2022 at 12:30 pm

Will send you the link!

Donald Lalonde · February 2, 2022 at 3:48 pm

Hi Pashtun, I am looking to get the link to the Basic Crypto&Stocks Investment tracker please. Thank You

Pashtun · March 1, 2022 at 7:04 pm

Email has been sent.

Carlos Oliveira · February 20, 2022 at 11:43 am

Hi,

I’ve registered here but didn’t get any email or link for tracker.

Please let me know how to get that.

Thanks in advance.

Pashtun · March 1, 2022 at 7:04 pm

Email has been sent.

online pharmacies · February 28, 2022 at 4:03 pm

I’m not sure exactly why but this web site is loading very slow for me.

Is anyone else having this problem or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

Pashtun · March 1, 2022 at 7:01 pm

Unfortunately, there was a spam attack on February 28th. The website should have recovered by now. Let me know if you still have issues.

Nik · March 3, 2022 at 6:49 pm

Hi Pashtun,

To be honest, I did not receive an email with the link to the spreadsheet. Could you please share it with me?

Also I am very excited to try out your premium tracker! Wouldn’t you mind sharing how to get the access to the premium one? If it is out from beta version, how much would it cost?

Thank you for helping us on our financial journey. 🙂

Yours sincerely,

Nik

Pashtun · March 3, 2022 at 6:56 pm

I sent you an email with the link. The cost will most likely be 25 euros.

Jay · March 26, 2022 at 6:08 pm

Hi Pashtun,

Thanks for this tool, seems to be great!

Just subscribed to the newsletter. can you pls share the link when possible?

Cheers!

J

Pashtun · April 21, 2022 at 12:19 pm

Please check your inbox, including spam mail.

drugstore online · March 31, 2022 at 8:50 am

I have been surfing online more than 4 hours today, yet I never found any interesting

article like yours. It is pretty worth enough for me.

In my view, if all website owners and bloggers made good content as you did, the

web will be much more useful than ever before.

Pashtun · April 21, 2022 at 12:19 pm

Thank you for the compliment!

online medicine to buy · April 8, 2022 at 12:53 pm

Heya i’m for the primary time here. I found this board and I find It really helpful

& it helped me out a lot. I hope to offer one thing back and aid others such

as you aided me.

Pashtun · April 21, 2022 at 12:20 pm

Glad to you hear I could help you!

Lawrence · April 13, 2022 at 5:49 pm

Hi Pashtun

I Have been searching for a Crypto-Tracker Program, and came across COINATLAS, which looks fantastic. I have tried to subscribe, but am not receiving any email links to the spreadsheet?

Many thanks

Lawrence

Pashtun · April 21, 2022 at 12:21 pm

Just sent you an email and provided you with the link to the premium tracker.

james · May 26, 2022 at 2:47 pm

Hi Pashtun,

I’ve downloaded your basic crypto & stock tracker, I’m just wondering how does the tracker handle buying assets in various currencies? For example, I’ve bought BTC in GBP and USD on the same exchange. Is there a way to enter my buys in the history tab in the currency they were bought in and still have all other calculations make sense (such as market value and profit of portfolio)?

Thanks.

James

Pashtun · April 13, 2023 at 8:00 pm

You can enter the buys in whatever currency, but the dashboard will only display the total amount in one currency. It will re-calculate everything to this one currency.

canada pharmacy · June 17, 2022 at 7:56 am

hey there and thank you for your information – I’ve definitely picked up anything new from right here.

I did however expertise several technical points using this site, since I experienced to reload the

web site a lot of times previous to I could get it to load properly.

I had been wondering if your web hosting is OK?

Not that I am complaining, but sluggish loading instances times will often affect your

placement in google and can damage your high-quality score if advertising and marketing with Adwords.

Anyway I’m adding this RSS to my e-mail and can look out

for much more of your respective intriguing

content. Ensure that you update this again very soon.

Pashtun · April 13, 2023 at 7:59 pm

Sorry to hear you had trouble with the website. I don’t have ads on this website. I was absent for some time but will be more active again.

canadian pharmacies · July 20, 2022 at 5:22 am

I am no longer sure where you’re getting your info, however great topic.

I needs to spend a while finding out more or working out more.

Thanks for fantastic info I was on the lookout for this information for my mission.

viagra tablets australia · November 7, 2022 at 1:52 pm

Hello there! I could have sworn I’ve been to this website before but after browsing through a few of the posts I realized it’s new

to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking it and checking back regularly!

tadalafil 20 mg · November 14, 2022 at 6:13 pm

I’m impressed, I have to admit. Seldom do I encounter a blog that’s both equally educative and engaging,

and let me tell you, you’ve hit the nail on the head.

The issue is something not enough men and women are speaking intelligently about.

I am very happy that I came across this in my search for something regarding this.

Pashtun · April 13, 2023 at 7:57 pm

Thank you for those kind words. Really appreciate it.

Generic cialis tadalafil · December 16, 2022 at 4:25 am

Do you mind if I quote a few of your articles as long as I provide credit and

sources back to your website? My blog is in the exact same niche as yours and my users would definitely benefit from some of the information you provide here.

Please let me know if this alright with you. Cheers!

Pashtun · April 13, 2023 at 7:57 pm

Sure, you are free to refer to this website. Feel free to contact me if you are interested in a collaboration.

how much are google courses · December 23, 2022 at 8:29 pm

I am truly delighted to glance at this webpage posts which carries lots of helpful

facts, thanks for providing such statistics.

Pashtun · April 13, 2023 at 7:56 pm

Happy to hear you found it useful!